- #Oneline lighting calculation tool portable#

- #Oneline lighting calculation tool series#

include the calculated amount at other work-related expenses in your tax return and enter ‘COVID-hourly rate’ as the description.use the shortcut method calculator and enter the number of hours you worked from home between 1 July 2020 to 30 June 2021 – you must keep a record of your work hours (timesheets, diary notes or rosters).If you use the shortcut method to claim a deduction in your 2020–21 tax return:

electricity and gas for heating, cooling and lighting. the decline in value of equipment and furniture. The shortcut method (80 cents per work hour) covers all your work from home expenses, such as: The all-inclusive temporary shortcut method was introduced from 1 March 2020 due to the COVID-19 pandemic and the increased number of employees working from home. But make sure you meet the criteria and record-keeping requirements for each method.įor the 2019–20 income year, if you worked from home before 1 March 2020, you may need to use more than one of the three methods to work out your total deduction for the year.Īccess the Home office expenses temporary shortcut method calculator You can use the method or methods that will give you the best outcome. Actual cost method – use the actual cost method. Fixed rate method (52 cents) – use the fixed rate method. Shortcut method (all-inclusive rate of 80 cents per work hour) temporary due to COVID-19 – use the shortcut method. There are three methods to calculate home office expenses depending on your circumstances: If your home is your principal place of business, you should refer to running your business from home. These can be additional running expenses such as electricity, the decline in value of equipment or furniture and phone and internet expenses. If you're an employee who works from home, you may be able to claim a deduction for expenses you incur relating to that work. that you're reimbursed for, paid directly by your employer or the decline in value of items provided by your employer – for example, a laptop or a phone. related to children and their education – this includes setting them up for online learning, teaching them at home or buying equipment such as iPads and desks. for coffee, tea, milk and other general household items your employer may otherwise have provided you with at work. Expenses you can't claimĮmployees generally can't claim occupancy expenses such as rent, mortgage interest, water and rates.Įmployees who work at home can't claim costs: Use these results as an estimate and for guidance purposes only. Your results are based on the information you provide and the rates available at the time of calculation.

electricity and gas for heating, cooling and lighting. the decline in value of equipment and furniture. The shortcut method (80 cents per work hour) covers all your work from home expenses, such as: The all-inclusive temporary shortcut method was introduced from 1 March 2020 due to the COVID-19 pandemic and the increased number of employees working from home. But make sure you meet the criteria and record-keeping requirements for each method.įor the 2019–20 income year, if you worked from home before 1 March 2020, you may need to use more than one of the three methods to work out your total deduction for the year.Īccess the Home office expenses temporary shortcut method calculator You can use the method or methods that will give you the best outcome. Actual cost method – use the actual cost method. Fixed rate method (52 cents) – use the fixed rate method. Shortcut method (all-inclusive rate of 80 cents per work hour) temporary due to COVID-19 – use the shortcut method. There are three methods to calculate home office expenses depending on your circumstances: If your home is your principal place of business, you should refer to running your business from home. These can be additional running expenses such as electricity, the decline in value of equipment or furniture and phone and internet expenses. If you're an employee who works from home, you may be able to claim a deduction for expenses you incur relating to that work. that you're reimbursed for, paid directly by your employer or the decline in value of items provided by your employer – for example, a laptop or a phone. related to children and their education – this includes setting them up for online learning, teaching them at home or buying equipment such as iPads and desks. for coffee, tea, milk and other general household items your employer may otherwise have provided you with at work. Expenses you can't claimĮmployees generally can't claim occupancy expenses such as rent, mortgage interest, water and rates.Įmployees who work at home can't claim costs: Use these results as an estimate and for guidance purposes only. Your results are based on the information you provide and the rates available at the time of calculation.  Access the Home office expenses calculator – to work out your expenses using the fixed rate or actual costs methods. Access the Home office expenses shortcut method calculator – to work out your expenses using the all-inclusive 80 cents per work hour temporary shortcut method. Quick Delivery Service – Eaton’s Quick Delivery Service within 3 working days helps you to react to unpredicted situations in a flexible way.Use our home office expenses calculators to work out your claim for work-related expenses you incur as a result of work you do from home as an employee. Project Management Services – Eaton can help reduce project risk, lower project cost, shorten your overall project schedule and allow your plant to start up earlier.

Access the Home office expenses calculator – to work out your expenses using the fixed rate or actual costs methods. Access the Home office expenses shortcut method calculator – to work out your expenses using the all-inclusive 80 cents per work hour temporary shortcut method. Quick Delivery Service – Eaton’s Quick Delivery Service within 3 working days helps you to react to unpredicted situations in a flexible way.Use our home office expenses calculators to work out your claim for work-related expenses you incur as a result of work you do from home as an employee. Project Management Services – Eaton can help reduce project risk, lower project cost, shorten your overall project schedule and allow your plant to start up earlier.

Certified Assembly Partner – A “Crouse-Hinds Series Certified Assembly Partner – CAP” is a point of contact for Eaton’s products in your area.Local Service – In order to address the needs of the customers Eaton offers local and personal support!.Ecologically Friendly – Energy-efficient and environmental friendly CEAG Ex-Luminaires lead to a good ecobalance.

Ease of Maintenance – Portable explosion-protected power units and Ex-luminaires will reduce the cost of maintenance and repair in your plant. Reliability – Areas where failures may be cost intensive: Ex-luminaires and -switchgears from Eaton are extremely reliable. Products for Extreme Conditions – Challenging and hazardous environments require well engineered solutions and products!. Regenerative Energy – Power distributions for harsh conditions. Dust – a Safety Risk – Eaton provides dust explosion-protected switches, motor intermediate terminal boxes and plug devices. Ships and Marine – Many CEAG products fulfils the actual shipping certifications. Food and Beverage – CEAG products made of stainless steel for the food industry.

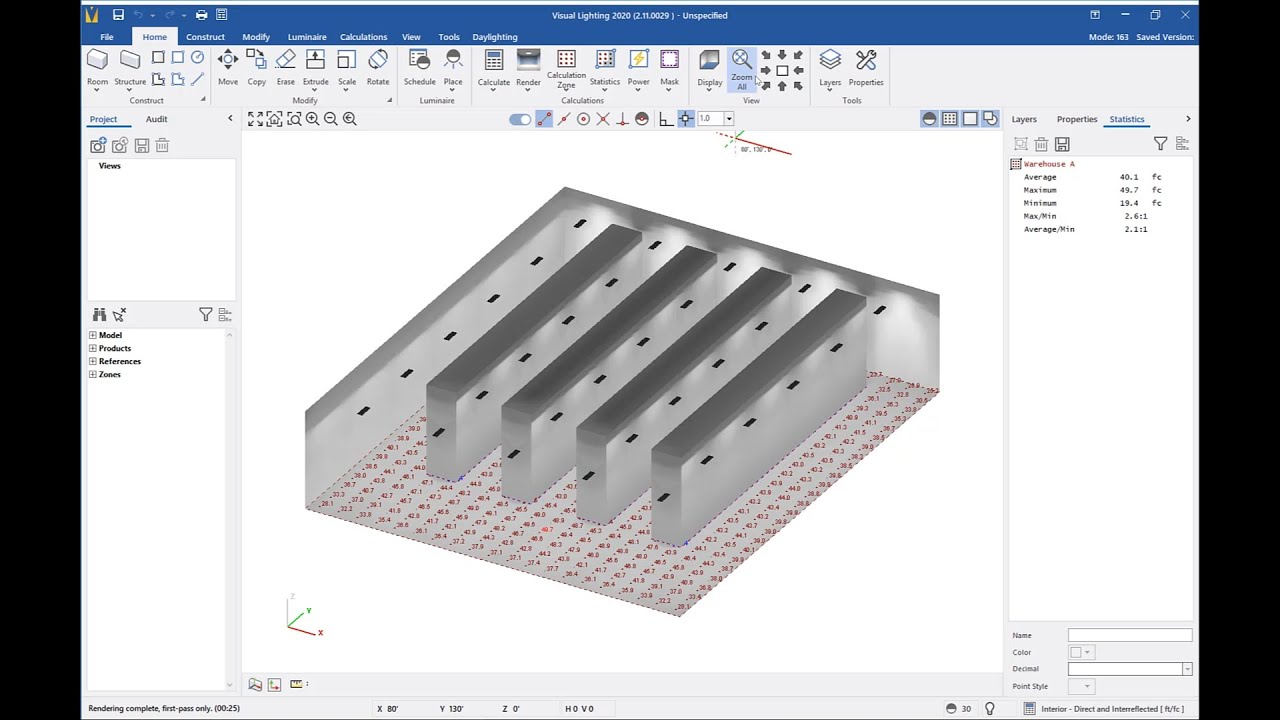

Mining – The products of Eaton’s Crouse-Hinds Series are exceptionally durable and corrosion-resistant. Industry – Comprehensive solutions through products from CEAG and Crouse-Hinds Series. Oil and Gas – Ex-Protection for global Oil and Gas Industries. Switch Disconnector according to IEC/EN 62626-1. Return of Invest (ROI) LED Cost-Calculation. Workshop hall Illumination with IHB LED.

0 kommentar(er)

0 kommentar(er)